Blog Detail

- Home

- Blog Detail

- February 18, 2025

AI Solutions for Insurance Marketing: Top Strategies

The insurance industry is changing fast. Old marketing methods no longer work well. Generic ads and broad campaigns fail to connect with customers. Many companies struggle with customer segmentation and predicting behavior. They also send messages at the wrong time.

AI solutions for insurance marketing offer a game-changing approach. AI helps insurers target the right people with the right message. It improves customer experience and boosts sales. Companies can now use AI to track trends, analyze data, and improve marketing strategies.

The impact of AI is huge. Experts predict AI solutions for insurance marketing will reach $35.77 billion by 2030. It will grow at a rapid rate of 33.06% per year. Businesses that invest in AI will gain a big advantage. They will see better engagement and higher profits. AI is no longer the future—it is the present.

The Impact of AI for Campaign Performance in Insurance

AI changes how insurance companies run campaigns. It helps them find the right customers. It also makes ads work better. Many insurance businesses use AI for fast results. It helps them spend less money on ads.

AI looks at customer data quickly. It finds patterns in buying habits. Companies use this to show the best offers. It also helps in making personal ads. These ads bring in more customers.

AI also helps in fraud detection. It catches fake claims fast. This saves companies a lot of money. It also improves customer service. AI chat tools answer questions quickly. This keeps customers happy.

AI improves campaign tracking. It checks what works best. Companies change their plans based on AI reports. This leads to better sales.

Insurance businesses get better profits with AI. They reach more people in less time. It also makes marketing easier. AI changes how insurance companies grow. It will shape the future of the industry.

The Impact of AI for Campaign Performance in Insurance

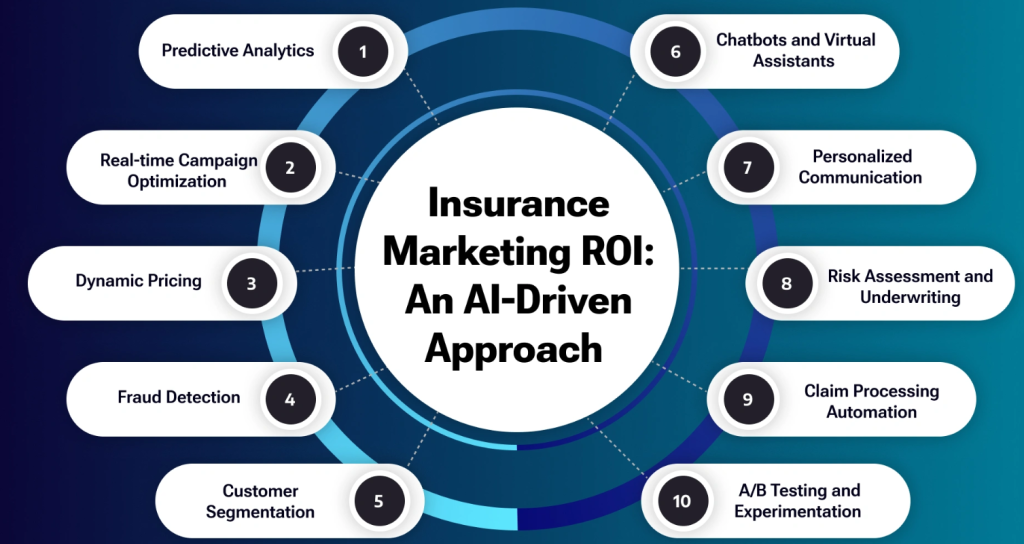

Insurance companies want better results from their campaigns. They need fast, smart, and cost-effective strategies. AI solutions for insurance marketing improve campaign success. AI makes decisions based on real-time data. It helps companies connect with the right customers. It also saves time and reduces mistakes. Here are key ways AI improves insurance marketing.

Predictive Analytics

AI predicts customer behavior using past data. It studies purchase history, preferences, and patterns. This helps companies design better campaigns. AI also helps them target the right audience. Businesses offer policies based on real needs. This increases customer satisfaction and sales.

Real-Time Campaign Optimization

AI tracks campaign performance every second. It finds what works best and what needs change. It adjusts ads and messages based on data. This improves engagement and boosts results. Companies stop wasting money on poor campaigns. They focus on what drives success. AI helps businesses stay ahead in a fast-changing market.

Dynamic Prices

AI changes prices based on customer risk and market demand. It analyzes factors like driving history, health records, and claims data. This helps companies set fair prices. Customers get the best rates based on their profile. AI makes pricing competitive and transparent.

Fraud Detection

AI detects fraud by scanning claims and customer records. It finds unusual patterns that may signal fraud. It alerts companies before they lose money. This helps businesses process claims safely. Customers also get fair and faster claim approvals. AI reduces financial risks for insurance companies.

Customer Segmentation

AI divides customers into different groups. It looks at age, income, and interests. Companies use this data to send the right offers. Customers receive policies that fit their needs. This improves customer experience and increases trust. AI helps businesses target the right people with the right message.

Chatbots and Virtual Assistants

AI-powered chatbots answer customer questions instantly. They work 24/7 without breaks. Customers get fast and accurate responses. This improves customer satisfaction. Chatbots also reduce the workload for human agents. Companies save money while improving customer service. AI makes support more efficient.

Personalized Communication

AI sends messages based on customer interests. It creates emails, texts, and ads that match their needs. Customers feel valued and trust the company more. This leads to better engagement and more sales. AI helps businesses build strong customer relationships.

Underwriting and Risk Evaluation

AI checks customer risk before approving policies. It looks at health records, driving habits, and claim history. This helps businesses set fair policy rates. Customers get prices based on real risk factors. AI speeds up approvals and reduces mistakes.

Automated Processing of Claims

AI makes claim processing fast and simple. It reviews documents and verifies details in seconds. This reduces waiting times for customers. Companies process claims faster and improve service quality. AI increases efficiency and reduces manual work.

Best Practices for Implementing AI in Insurance Marketing Campaign

Set Clear Goals and KPIs:

Companies must define goals before using AI solutions for insurance marketing. They should focus on key performance indicators (KPIs). Clear goals improve campaign success. AI helps track customer behavior. It also measures marketing effectiveness. Businesses can adjust strategies based on real data.

Build a Strong Data Foundation:

AI solutions for insurance marketing depend on quality data. Companies must collect accurate customer details. They need to store information securely. Organized data improves AI decision-making. It also reduces errors in predictions. Better data means better results.

Build a Skilled Team:

A knowledgeable team improves AI-driven campaigns. Experts must understand AI tools. They should know how to analyze data. Training helps employees use AI effectively. Skilled teams create better marketing strategies. Companies must invest in learning programs.

Choose the Right AI Tools:

Many AI solutions for insurance marketing exist. Companies must pick the right tools. They should consider automation, data analysis, and fraud detection. AI tools must fit business needs. The best tools boost efficiency. They also enhance customer experience.

Focus on Customer Segmentation and Personalization:

AI helps divide customers into groups. It analyzes behavior patterns. AI also personalised marketing messages. Tailored content increases engagement. Personalized offers attract more customers. Better targeting leads to higher conversion rates.

Continuous Monitoring and Evaluation:

AI needs constant tracking. Companies must check performance regularly. AI tools collect campaign data. Businesses can adjust strategies in real time. Regular monitoring prevents errors. Ongoing evaluation ensures better results.

How to Measure the Success of Marketing Campaigns in Insurance

Measuring the success of marketing campaigns in the insurance industry, particularly those powered by AI, requires a more advanced, data-driven approach than traditional methods. To gain a deeper understanding and more accurately evaluate performance, it’s essential to focus on key areas and use the right metrics. Here’s how to effectively measure success:

Model Effectiveness:

To start, assess the performance of AI models. These models predict crucial metrics, such as customer lifetime value (CLTV), and help identify at-risk customers. Additionally, AI plays a significant role in audience segmentation for tailored messaging. To evaluate these models, it’s important to use metrics like mean absolute error (MAE), root mean squared error (RMSE), and F1-score. These metrics measure the precision and reliability of AI predictions, ensuring that AI-driven strategies are performing as expected and delivering accurate results.

Campaign Effectiveness:

Once model effectiveness is evaluated, the next step is to analyze how AI-driven insights impact key business outcomes. These include return on investment (ROI) and conversion rates. It’s also beneficial to compare AI-powered campaigns with traditional methods to highlight performance differences. Key metrics to focus on are policy sales, premium revenue, and customer retention. By tracking these indicators, companies can gauge the value that AI brings to customer engagement and overall business growth.

Customer Experience:

Improving customer satisfaction remains a core goal for any marketing campaign. To assess how well AI is enhancing this aspect, consider metrics like click-through rates, open rates, response rates, and net promoter scores (NPS). These metrics help show how AI influences customer interactions. Additionally, AI-powered tools, such as chatbots and virtual assistants, can improve service efficiency. By tracking how these tools help resolve issues, you can evaluate their direct impact on the overall customer experience.

Ongoing Enhancement:

Moreover, continuous optimization is essential for maintaining success. Regular updates to AI models, improving data quality, and conducting A/B testing are all vital to ensuring campaigns stay relevant. It’s important to track the performance of AI models over time and leverage insights from previous campaigns to refine strategies. This ongoing improvement helps ensure that campaigns remain effective and aligned with the evolving needs of customers.

By focusing on these areas and using the right metrics, insurance companies can gain a clearer understanding of how AI impacts their marketing campaigns. This data-driven approach not only helps companies make informed decisions but also enables them to optimize their strategies.

AI Solutions for Insurance Marketing: Overcoming Challenges

AI solutions for insurance marketing offer great potential, but they come with challenges. First, integrating AI into existing systems can be tough. Insurance companies must upgrade their technology to handle AI-driven processes. This can be time-consuming and costly.

Second, data quality is crucial. Without clean, organized data, AI can’t perform well. Insurance companies need to ensure they collect accurate and complete information. Otherwise, AI models may provide inaccurate predictions.

Third, understanding customer behavior is complex. AI solutions for insurance marketing aim to predict customer needs, but it can be difficult. Different customers respond to various marketing strategies in unique ways. AI must learn these patterns to be effective.

Another issue is the need for skilled staff. Insurance companies may lack experts who can manage AI tools. Hiring or training employees with the right skills is essential to success.

Lastly, trust is important. Customers must feel confident in how their data is used. Insurance companies must prioritize data security and transparency when using AI.

By addressing these challenges, companies can make AI solutions for insurance marketing work better, improving customer engagement and campaign results.

Real-World Examples of AI Solutions for Insurance Marketing Success

The insurance industry is becoming more competitive. As a result, many companies are turning to AI solutions for insurance marketing campaigns. These tools not only improve customer targeting but also personalize content and optimize ad spend. As a result, marketing ROI sees significant improvements.

Here are several real-world examples of insurance companies successfully using AI to drive campaign success:

Allianz: Personalizing Customer Engagement

Allianz, a global insurance leader, has embraced AI to enhance customer experience. For instance, their AI-powered chatbot offers real-time support, which significantly boosts lead conversion. By analyzing customer data, Allianz customizes its marketing strategies. As a result, customer retention increases, and marketing ROI grows by 20%.

Progressive: Optimizing Digital Ads and Targeting

Progressive, a key player in the U.S. auto insurance market, uses AI to refine digital ad campaigns. Specifically, AI analyzes ad performance and customer behavior. With this data, Progressive can target high-potential customers with personalized ads. Consequently, costs are reduced, and conversions rise by 25%.

Lemonade: Enhancing Customer Acquisition

Lemonade, a forward-thinking Insurtech company, utilizes an AI-powered chatbot named Maya. Maya automates interactions, offers personalized quotes, and improves customer satisfaction. In addition, it lowers operational costs. By predicting customer behavior, Lemonade increases customer lifetime value, which results in a 30% higher marketing ROI.

MetLife: Predicting Customer Behavior

MetLife, a global insurer, uses AI to automate and optimize marketing campaigns. By analyzing customer data, MetLife can predict future behavior and determine the best time to send offers. As a result, conversion rates increase by 15%, leading to a higher marketing ROI.

AXA: Enhancing Social Media Strategy

AXA, an international insurance company, leverages AI to improve its social media content. AI helps analyze trends and customer sentiment, allowing AXA to create highly engaging content. As a result, customer engagement increases by 20%, and marketing ROI improves by 17%.

These examples clearly show the power of AI solutions for insurance marketing campaigns. By using predictive analytics, personalized content, and automated campaign strategies, these companies have significantly boosted customer acquisition, retention, and ROI.

Future Trends of AI in Insurance

AI is changing the insurance industry. Companies use AI to improve marketing, customer service, and overall efficiency. Several key trends will shape the future of AI in insurance.

Smarter Content Creation with AI

AI-powered tools will make content creation faster and more effective. Insurance companies will use AI to write website content, create social media posts, and send personalized video messages. These messages will match customer needs and build stronger connections.

Automation for Faster Processes

AI will automate many tasks in the insurance industry. Marketing teams will complete jobs faster and focus more on customer relationships. Companies will improve operations, reduce costs, and use AI to analyze customer behavior.

Virtual Reality and the Metaverse

The metaverse will offer new ways to connect with customers. Insurance companies will use virtual reality to show products in action. Customers will experience interactive insurance plans before making decisions.

Real-Time Personalization

AI will make marketing more personalized. Companies will send offers and messages based on real-time data. Customers will receive relevant information that matches their needs at the right time.

Building Trust with Explainable AI

Customers want to understand how AI makes decisions. Companies will use explainable AI to increase transparency. Clear explanations will help customers feel more confident when choosing insurance policies.

AI-Powered Customer Support

Chatbots and virtual assistants will become smarter. They will answer questions, solve problems, and predict customer needs. AI will make customer service faster, more accurate, and always available.

Protecting Customer Data

Companies must handle data responsibly. AI will follow strict rules to protect customer privacy. Ethical AI use will build trust and ensure fair treatment for all customers.

Merging AI with Other Technologies

AI will work with blockchain, smart devices, and other new technologies. This will create better security, improve processes, and offer new ways to serve customers.

Continuous Improvement and Learning

AI keeps evolving. Companies must stay updated and adapt to new AI trends. Those who learn and improve will lead the insurance market.

AI in insurance will make marketing smarter, processes faster, and customer experiences better. Companies that use AI wisely will grow and succeed in the future.

Partner with Copula Global to Leverage AI for Insurance Marketing Success

Copula Global helps insurance companies use AI to improve marketing and increase sales. AI-powered tools create personalized content, automate tasks, and analyze customer data. This leads to better engagement and higher conversions.

With AI, insurers can send real-time offers, improve customer support, and enhance digital campaigns. Copula Global provides cutting-edge solutions to streamline operations and boost marketing ROI. Businesses can save time, reduce costs, and build stronger customer relationships.

AI also ensures data security and accurate risk assessments. Partnering with Copula Global gives insurance companies a competitive edge. Stay ahead with smart automation, advanced analytics, and personalized marketing strategies. Work with Copula Global and transform your insurance marketing today.